Probate/Wills/Estate Law

Estate planning and administration encompasses a broad array of legal issues. If you are concerned with protecting your assets and passing them down to your loved ones, then we can be of assistance. We can also help administer an estate, and help you maneuver through the probate process.

Our goal with estate planning is to minimize taxation, and maximize your net assets, that you can then pass on to your beneficiaries. Our probate services are designed to swiftly and efficiently resolve any outstanding financial issues of the estate.

Our estate services cover:

- Wills

- Trust Creation and Litigation

- Probate Administration

- Estate Planning

For more information on our services, contact our firm today for your free consultation.

Probate/Wills/Estate Planning FAQ

- Do I need a will?

- Will my assets always be distributed in accordance with my will?

- Can I leave my assets to anyone? Can I leave my spouse and children out of my will?

- What is a living will and should I have one?

- What is a Durable Power of Attorney and should I have one?

- How often should I update my will or my estate planning documents?

- What is probate?

- How long does probate take?

- What does the executor do?

- Can I avoid probate?

If you would like to have a say in how your assets are distributed after your death, then yes, you need a will. In North Carolina, if you don’t have a will, your assets will be passed on through North Carolina’s Intestacy laws.

This means, if you’re married, your assets would be divided between your spouse and your children. If you’re not married, it would pass to your children, or if there are no children, to your parents or siblings. A will is usually a simple thing to create, and can provide much greater control over how your estate is handled.

Also, if you have minor children, a will can designate who will be their guardian should something happen to you and your spouse. It can also specify how the proceeds from your estate should be set up to benefit your children. Normally, this is accomplished through setting up a trust for the children, which allows you to designate how, and when the money can be dispersed.

No. There are often third party agreements that will control how your assets are distributed. For instance, if you have a life insurance plan and that contract designates your son as a beneficiary, then he would get the proceeds from that policy, regardless if your will said otherwise.

In general, you can choose where your assets go. There are usually state laws, however, that stipulate that a surviving spouse does have an interest in the estate of the deceased, even if they’re left out of the will.

Some states also regulate how much you can donate to charity if you still have a surviving spouse or children. You can disinherit your children, though it’s best to state the disinheritance specifically in the will so there can be little room left for trying to contest the will.

A living will is a document that states what your wishes are in regard to life sustaining measures. Should you become terminally ill, or incapacitated in a vegetative state, this document states what you would like your physicians to do on your behalf.

In most cases, a living will is a good idea. It can save your family a lot of agony over trying to make painful medical decisions while dealing with emotional grief and turmoil.

This is a document that stipulates who can legally act on your behalf should you become physically or mentally incapacitated. This can encompass legal, financial, and personal decisions in your life.

You can also designate different people for different aspects of your estate. For instance, you can have a health care power of attorney that only deals with your medical care. This person would be able to make medical decisions on your behalf once your designated doctor has determined that you are unable, or lack the capacity, to make these decisions on your own.

If you don’t have a power of attorney, the court will appoint someone for you and pay for their services through your estate.

Whenever a major life occurrence has happened – marriage, birth, adoption, divorce – it’s always a good idea to update your estate plan. You should also look over them every few years, as changes in the tax law, or in your financial situation, might necessitate important changes to your plan.

Probate is the process that transfers the assets of the deceased to the proper beneficiaries. Through this process, the existence of a valid will is determined, and proof of legal heirs is verified. .

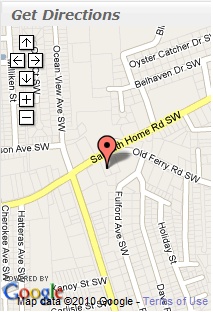

Probate occurs in the County where the deceased permanently resided at the time of death. It is handled in the probate court, which handles all the personal property, as well as real estate that the deceased owned in that state.

It really depends on the size and complexity of the estate, as well as the time it takes to find and notify the beneficiaries. If a will is contested, or someone objects to the handling of the estate, it can prolong the process.

Any assets that are owned solely by you, and not in joint tenancy, in a trust, or have a designated beneficiary are included in probate.

So for instance, if you own a house with someone through joint tenancy, that would be excluded from probate. Proceeds from an IRA, life insurance policy, or annuities that have designated beneficiaries in the contract, would also not pass through probate.

The executor is in charge of compiling all the assets together of the estate, paying off any outstanding debts, and distributing the remaining assets as was designated in terms of the will.

Yes. There are legal entities like a living trust that can make probate unnecessary. If a living trust holds legal title to your property at the time of your death, the entity survives after your death, and no probate is required.